Silver Financing Mechanisms - Latvia Report

The report follows two seminars about the “Silver Financing Mechanisms” held on

in April and May of 2020. The report answers to the following research

questions:

-

What are the existing funding and financing mechanisms in the region?

- What are the present and future needs in the silver economy, and what are the

possibilities to finance and fund those needs?

- What are the barriers and possibilities in the present and the future financing

and funding mechanisms?

- Is there a possibility to have a single window services for finance and fund

new products, services and processes?

- Other findings and remarks

- Recommendations to the future financing and funding mechanisms

What are the existing funding and financing mechanisms in the region?

In Latvia, innovation ecosystem has seen tremendous development in the recent decade. This has been possible due to many reasons. We name a few. After becoming part of the European Union (since 2004) it took some years of learning how to swim together with more developed countries before the development could start accelerate in Latvia. Thanks to the extensive international collaboration and participation in multitude of European projects by all actors of quadruple helix (academia, public institutions, business and NGO). We must acknowledge the welcoming attitude towards Latvia from the European countries, whose international and free trade collaboration lasts for many decades and in some cases for centuries. Another reason we have to note is that a new generation born in Latvia in the years of the collapse of Soviet system (1989 - 1992) is in their graduate and post-graduate years. This generation very much differs as they have been raised in a highly enthusiastic and open system that was not possible for several predecessor generations. The new generation has taken lead and is providing a completely new mind-set in adapting and creating the systems of innovation ecosystem development.

With a short historical background we can understand why today there is a striving

innovation ecosystem in Latvia. Not flawless or complete, but still developing,

adapting and changing to face the new challenges and environments around.

Getting now to a financing of new companies in Latvia. As of today in Latvia there exist miscellaneous instruments that have been internationally approved and tested. Incubators, accelerators, grants for business starters, soft loans, venture capital and private investment possibilities, cross-border international, European and regional programmes are available in Latvia. Different business support organizations have been created and operates in all regions of Latvia. Public institutions are more and more recognizing entrepreneurship as an important part of the society development efforts.

Among state institutions we have to mark out the Latvian Investment and Development Agency, a special unit of the Ministry of Economics, that is the most known public business support organization in Latvia. It deals with an immense number of programs and initiatives to encourage business development, business growth, exports and investments into business advancement.

Another strong organization that is operating country-wide is the Latvian Chamber of Commerce and Industry. It is the largest NGO for businesses in Latvia. They have been building organization basically from the scratch since 2000’s. In the last decade, the number of members has increased from hundreds to thousands. The Chamber is running an event (on all sorts of business aspects) almost every working day throughout the year.

Universities are playing key role in stimulating entrepreneurial growth. They are now involved in many European wide competitions and programs for business mind-set development. Universities established their own business incubation and technology transfer units. A remarkable input is an enormous infrastructure development in almost all universities in the capital city Riga and regional centres. The two largest Latvian universities – University of Latvia and Riga Technical University – have built number of new houses for teaching, research and society outreach purposes. University of Latvia has decided to build entirely new campus on a new territory that is now at about 30% completed and is already operating with two large and modern university buildings. These infrastructure developments brings new passion to the students, professors and society at large, and motivates for self-development and innovative thinking.

In the picture we can see financing ecosystem in Latvia that was prepared by the Latvian Startup Association, another recently established and active organization in the business startup sector in Latvia. It shows the different dimensions, angles and scope of the financing instruments across the development stages of a startup company.

Picture 1. Investment opportunities and financial support for startups in Latvia. Prepared by the Ministry of Economics of Latvia and Latvian Startup Association “Startin.LV”.

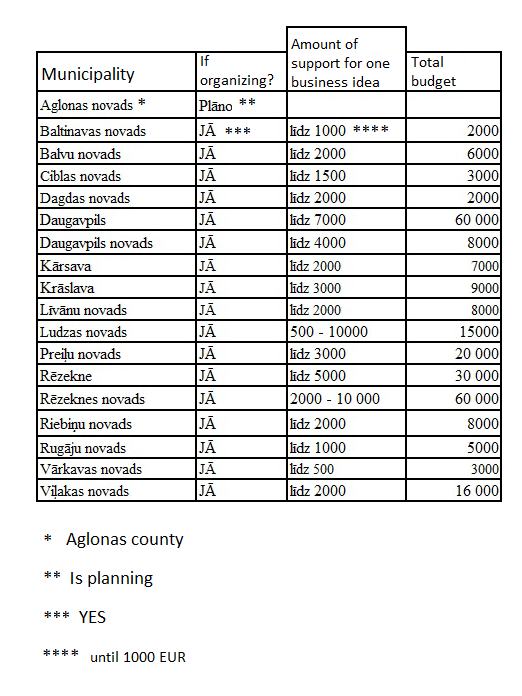

Another excellent example of the financing programs that are available in Latvia and in particular, non-capital regions, is shown in the table below (author Andris Kucins, the head of Latgale Entrepreneurship Centre at Latgale Planning Region). It shows municipalities of one of the four administrative regions of Latvia – Latgale, which is located on the south-east of the country. Almost every municipality nowadays organize larger or smaller funding program for business startup in the respective municipality. And the popularity of these instruments is growing.

Picture 2. Business support in Latgale. Prepared by Andris Kucins, Latgale Entrepreneurship Centre of Latgale Planning Region.

What are the present and future needs in the silver economy, and what are the possibilities to finance and fund those needs?

At present we can split the needs and opportunities of the silver economy and senior citizens into three categories:

1) Additional income for seniors. In Latvia the silver economy must focus not on the products and services for seniors to consume, but on creating options and systems in place, where seniors can get additional financial income. This primarily includes more opportunities to work, favourable legal and other type of conditions for senior employment facilitation. In example, fostering technological change in companies or embodying employee and employer business relationships based on trust and sustainability. It is important to create business environment that encourages gradual retirement instead of sudden retirement. This must involve change of task setup at the working places (rotation of processes to reduce risks for getting chronic diseases, physical tasks mixing with non-physical) and most importantly, change of mind-set in the society in all quadruple helix types of organizations. Here we have two concrete proposals:

Proposal No. 1

One important way, in addition to different financing programs and support from funds, is effective organization of cooperative activity. Based on practical experience, jointly collected funds constitute a part of equity capital for larger projects and together with flexible credit system it is possible to undertake economically profitable and future-targeted projects that guarantee the members of credit unions stable additional income. Such economic model has worked very efficiently and raised economical insurance and well-being of elderly people in many countries.

Concrete example is the wave energy farm founded on a cooperative basis. Ca 1500 people, ¾ of whom are older than 55 years, have put together their savings. This investment brings them annually up to 10% of profit and they all have shares in cooperative project that also has, in addition to profitability, certain market value.

Proposal No. 2

Another specific proposal here is to create local employment projects for elderly people based on and assisted by local authorities. For that it is necessary to create workshops for people with different qualification in the framework of social projects and to offer them social orders e.g. to solve topics related to urban environment; for example to make decorations for public space (bus shelters, recycle bins etc). Introducing such social mechanisms will guarantee the employment for elderly people and also save budgetary funds of administrative units as using employment of elderly people replaces the payment to private companies.

2) Support functions to enable seniors’ wellness and increased quality of life. This include green walking areas or parks near residential housing, availability of public transport infrastructure, affordable and healthy food options, adapted infrastructure conforming with the needs of senior citizens, various support instruments such as IT help desk, apartment amenities improvement services, public space enhancement to put up benches, ensure fresh air, reduce unnecessary noise etc.

3) Empowerment of senior dreams. It is important to equip seniors with tools and instruments they need in order that they can fulfil their passions, hobbies, expertise in whatever field each one of them is good at. An example of a senior who pursues his engineering passion and travels through the life approaching all sorts of financing instruments on his way, is attached to this report as Appendix 3. Following this example, we can learn a lot about senior thinking and approach that can make them fulfilled in the journey of life.

What are the barriers and possibilities in the present and the future financing and funding mechanisms?

We believe that there are significant opportunities for new companies in Latvia. At first, as discussed during the seminars and as generally accepted current truth, there is a lot of money available in the market. There are different instruments available for specific purposes and stages of the company development. The success lies in the business plan and the determination of the person to realize it. The rest are technical details. Everyone with the right attitude, valid business idea and advice from experienced colleagues is capable to realize the business plan. If the mission of a newly organized company is to change the world for better or to make the world a better place, then nothing is impossible. Decision, determination, discipline and details are things to write on one’s shorts who wants to make things happen. Secondly, in Latvia there have been enormous growth in entrepreneurial mindset training and most of the people have the possibilities to undergo very high quality business startup training. These programs include topics from market research to branding, from finance planning to investor relationships management, from networking to mentoring, and so on. It makes up the hope of the business community that founders of new companies are well prepared to dive into this, sometimes complex, business world. Thirdly, Latvia and it’s quadruple helix members have built strong and close relationships with the partners in Europe, and beyond. These connections, linkages and friendships have enabled and will continue to enable Latvia to be part of the wider entrepreneurial and innovation community that is sharing and caring for each other.

Taking into account the possibilities described above and what financing instruments can provide today and in the nearest future, there are no realistic barriers that can stop a determination of a company founder and his/her team. As it was said during one of the mentoring sessions to nascent entrepreneurs by one of the entrepreneurs, who have been through number of his own projects startups and failures: “There are so many things at the initial phase of your company set-up that you can do without money! You cannot blame anyone for having no access to money. If you do all your home works diligently and prepare well then the money will come to you sooner or later once the project setup has proved to have competitive advantage.”

Is there a possibility to have a single window services for finance and fund new products, services and processes?

In today’s open access, big data, sharing economy world there is no possibility to have a single window service for new business and SME finance. It is simply impossible. Just imagine, there is no possibility to attract funding for your company in your country and the foreign support offices cannot help you either. Should you give up? No, as of today, there are no borders for communication, and anyone with a connection to internet (for a few dollars or even for free from public space), and a decent skills of language (or a friend who knows languages well), can go out and reach possible financiers and partners in the whole world, from Taiwan to South Korea, U.S. or U.K., and not the least, all across Europe.

In an open innovation ecosystem, where all players develop and change over time, one can only improve systems and services provided and thus become a main entrance point for companies seeking finance. But surely there will be other side doors (i.e., smaller and more efficient organizations, specific purpose players, regional expertise carrying organizations) where deals will be made too.

Other findings and remarks

There are two other findings and remarks following discussions at the seminars. One is related to the international community of companies and organizations with a vision to strengthen senior citizens in a digital world by providing access to senior-friendly services (and tools) for fulfilment of miscellaneous life, business and communication objectives. The Program is called Active and Assisted Living.

The Active and Assisted Living Program is a European initiative that aims to support better quality of life for older people and to strengthen industrial opportunities while ensuring sustainability of our health systems.

The AAL Programme promotes innovative technological product ideas and services for active and healthy ageing, supporting them until they launch on the market, by funding projects that work towards creating market-ready products and services for older people. Each project consists of SMEs, research bodies and end-user organisations. Since 2008, we have funded over 220 projects.

Latvia could make a leap step forward for senior citizens wellbeing by joining this European community. It is the right timing to take it to the agenda of respective Ministries in Latvia – Welfare, Education and Science, and Economics.

Another remark is concerning the welfare and social services for senior citizens in Riga city. Currently city council has outsourced these services to several NGO’s. However, in practice, this has shown that information exchange among the city council, NGO’s, their staff – caregivers, and senior citizens, goes slowly and sometimes does not circulate at all. For example, a caregiver of the NGO is not aware of what kind of technical assistance is available to a specific person in need and how this can be arranged. The suggestion thus is either to remove the intermediary NGO’s and employ caregivers directly by the city council, or to significantly improve, better to transform, the information flow processes and develop a culture of learning and “Yes, I can” among the caregivers and their employers.

Recommendations to the future financing and funding mechanisms

In order to give recommendations to the future financing mechanisms, a broader study is required. One of the recent books, actively used in Latvia, written by some of the dedicated mentors to Latvian nascent entrepreneurs, is “Show me the money” by Alan Barrell, David Gill and Martin Rigby. The book reveals in detail all the processes from assessing your business idea to preparing the fundraising and planning the future money supply chain. The book also includes a chapter on new and innovative finance sectors, including crowdfunding. This may well be one of our key recommendations to use the opportunities provided by crowdsourcing, crowdfunding and cooperative activity instruments in order to improve the well-being, access to services and possibilities to reach small and large personal goals of our senior citizens in Latvia.

We will wrap up this report by a quote of a typical, but famous Latvian senior Mr Miervaldis Rozenbergs: “If I had money, I would travel around the world, but with my pension I cannot travel anywhere. Therefore, to live a better life, you have to work to add to your pension”. Full story about Miervaldis can be seen on youtube: https://www.youtube.com/watch?v=UmUK4JXY7YY.

This report is prepared by Elmars Baltins, Rimis Vaitkus and Aarne Toomsalu on behalf of CONNECT Latvia team for the OSIRIS Project Group of Activities concerned with “Silver Financing Mechanism”.

Riga, 26th November 2020